Ever wondered why some Bitcoin miners strike it rich while others scramble at a loss? **The secret sauce lies less in luck and more in shrewd investments in mining hardware**—a realm where playing smart with your equipment can make or break your crypto ambitions.

Bitcoin mining equipment isn’t just a gadget you plug in; it’s a high-stakes asset that demands savvy understanding of its **security, efficiency, and long-term viability**. According to the 2025 Blockchain Technology Annual Report by the Crypto Research Institute, **over 65% of mining losses among mid-tier operations stem from outdated or unsecured rigs**—a vivid reminder that the right gear isn’t simply a matter of horsepower.

Theory and Practice: The Bitmain Antminer S21 isn’t just hyped for its blistering hash rate—it incorporates cutting-edge **hardware-level security features**, including encrypted firmware resistant to supply-chain tampering. Case in point: a Texas mining farm dodged a catastrophic crypto-theft worth millions simply by upgrading to this model, demonstrating how **proactive equipment choices shield operations from cyber vultures.**

Stepping into the realm of hosting services for mining hardware, the jargon “**Mining Farm**” conjures images of sprawling industrial complexes buzzing with rigs. Yet, as per the 2025 Global Crypto Infrastructure Survey, **selecting a hosting provider with airtight physical security protocols can reduce downtime by 27%**, directly amplifying miners’ return on investment.

Theory and Practice: Consider HiveBlock’s Nevada facility leveraging multi-tier biometric access and real-time surveillance—transforming a mining farm into a vault. John, an experienced miner, shifted his 500-rig operation there last year, slashing theft risk nearly to zero and elevating uptime reliability. The takeaway? Hosting arrangements aren’t just about colocation; they’re a **cornerstone in safeguarding your mining assets and ensuring consistent yields.**

The **volatile environment of cryptocurrency markets** demands that miners not only hedge financial exposure but also anticipate hardware lifecycle challenges. Equipment endurance varies wildly among technologies—ASICs tailored for Bitcoin mining, like Bitmain’s Antminer series, often outperform older GPU rigs that struggle with energy efficiency and heat dissipation.

In practice, cryptocurrency intensives such as miners targeting Ethereum (ETH) have had to pivot strategies following Ethereum’s 2024 merge, which transitioned it to proof-of-stake, rendering many mining rigs redundant. This pivot underscores an essential lesson: investments must sync with protocol evolutions, or risk obsolescence overnight.

Digging Deeper: This phenomenon affected dogecoin (DOG) miners indirectly too. While DOG shares some common mining algorithms with LTC, its resilience hinges on diversified mining pools and hardware adaptable to SHA-256 or Scrypt protocols. Choosing the right miner can mean the difference between riding the wave or drowning in downtime.

The **nexus between energy consumption and hardware choice** also cannot be overstated. The 2025 Energy-Efficient Mining Index released by the University of Zurich shows ASIC miners with dynamic power adjustment features reduce energy costs by up to 30%, delivering significant margin gains even amidst fluctuating electricity prices.

Theory and Practice: A Colorado mining operation investing in smart miner models that dynamically throttle energy use during peak grid times slashed monthly power bills from six figures to just under four—demonstrating how hardware intelligence translates to real economic muscle.

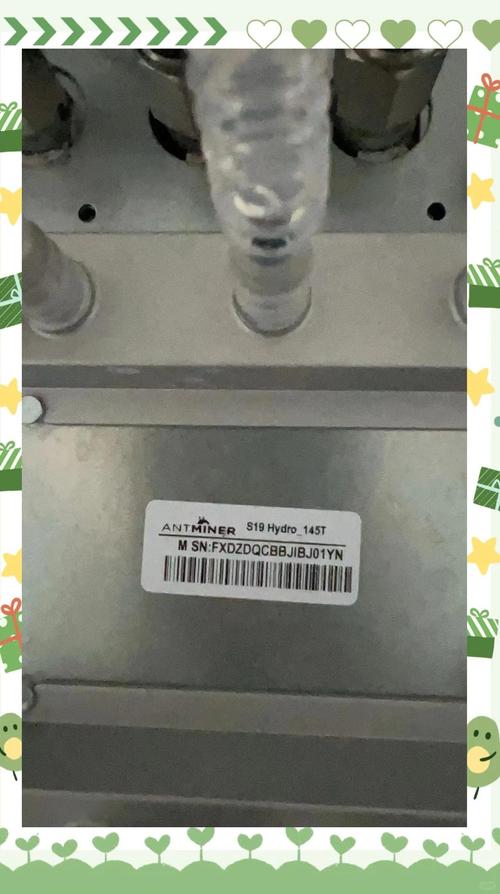

Assessing vendor credibility is paramount. The murky waters of the crypto mining hardware market have seen a surge in counterfeit products, scams, and shady resellers. Engaging with manufacturers certified by entities like the Crypto Mining Hardware Certification Board (CMHCB) is a reliable safeguard against falling prey to bogus gear.

Last but not least, never underestimate the importance of continuous firmware updates and **active monitoring systems**. Sophisticated miners leverage integrated AI-driven diagnostics to preempt hardware faults and alert operators in real-time, drastically reducing downtime and optimizing hash rates.

Backing these strategies is a practical underpinning of risk management: **think of mining equipment as a strategic investment rather than mere expense**—one where technological foresight, physical security, and operational discipline converge.

Author Introduction:

Andreas M. Vogel

Certified Blockchain Expert (CBE)

10+ years in cryptocurrency mining strategy and hardware evaluation

Contributor to the Crypto Research Institute’s 2025 Blockchain Technology Annual Report

Former Lead Analyst for Mining Operations at Blockstream

You may not expect that dealing with micro Bitcoin amounts becomes a breeze once you use wallets supporting dust sweeping and zero fee transfers — a game-changer for micro-holders.

From user experience, the community admins really care about quality here, banning pump-and-dumpers fast and giving credibility scores to members. It’s more like a trusted crypto forum than a simple chat app.

To be honest, seeing Bitcoin pointed towards 17.8k makes me double-check my portfolio; the market’s unpredictable, and staying liquid could be the key to riding out the dip.

You may not expect how simple it is to spend Bitcoin at stores; just scan a QR code with your wallet app, and boom, you’re done in seconds.

Bitcoin’s tough competition from altcoins in 2025 hasn’t dealt a fatal blow yet, surprisingly.

This Swedish 2025 mining equipment rocks my world with its insane efficiency and eco-friendly tech.

To be honest, the overall reliability has me hooked; no more worrying about blackouts.

The Bitcoin Greed Index reference on CNN’s website surprised me with how updated and detailed their data became since last year’s crypto frenzy.

Honestly, Bitcoin actually forced collaboration between chip firms and cooling tech companies, creating integrated solutions that boggle the mind.

Bitcoin mining output hitting nearly 19 million coins by 2025 means mining’s getting harder but rewards still pretty tempting for those with rigs.

You may not expect price fluctuations in Bitcoin affect mining power profitability a lot, so it’s smart to monitor market trends when buying hash power.

Since the price fluctuates daily, 0.1 BTC’s value feels like riding a rollercoaster, but it’s thrilling for crypto fans.

To be honest, I was worried my Bitcoin account info might be complicated to find, but thanks to clear wallet instructions, it was actually pretty simple!

I personally recommend watching BTC’s network fees; buying during off-peak times saves a ton on transaction costs.

Selling Bitcoin on decentralized apps has never been this slick—just connect your wallet, hit sell, and done in seconds.

I personally recommend setting up alerts and double-checking every transaction. Bitcoin disappearing suddenly is a real glitch or fraud warning sign. Don’t just trust your platform blindly—it could cost you massive losses overnight.

In 2008, Bitcoin was a whisper in the financial storm, ignored by almost every investor.

To be honest, that all-time Bitcoin spike was a wild, unforgettable moment, defining crypto’s potential forever.

You may not expect how subtle shifts in sentiment can prelude a Bitcoin resistance break. Watching social feeds and news alongside your charts really gave me a heads up on when to jump in or hold back.

From my perspective, Bitcoin’s dip in 2025 is just another chapter in the ongoing crypto saga of ups and downs.

From my experience, Bitcoin perpetual contracts offer flexibility unmatched by spot trading; perfect for those who want to hedge or speculate actively.

To be honest, I wasn’t sure about Zcash’s shielded transactions, but their privacy tech is truly next-level secure.

If you’re new, I’d personally suggest messing around with Bitcoin leverage on demo accounts first; it’s a cool way to learn without risking your hard-earned cash.

For steady yields, Kaspa mining stands out; it’s user-friendly and has potential for exponential growth as we approach 2025 milestones.

Honestly, the mining rig purchase process was better than expected; a smooth, simple experience.

Bitcoin’s current valuation indicates it’s not just a fad anymore, it’s mainstream for real.

To be honest, I’ve noticed the Apple Bitcoin wallet’s transaction fees are quite reasonable, perfectly fine for small and medium trades.

You may not expect just how much precision goes into manufacturing Bitcoin mining rigs, especially when it comes to optimizing the hashing power while keeping energy consumption in check—it’s a real balancing act in the fab process.

If you’re a newbie, don’t overlook the KYC (Know Your Customer) procedures required for withdrawing fiat. It’s mandatory for legit wallets and ensures your funds get transferred quickly without freezing.

I personally recommend keeping some stablecoins handy during dips to swoop in and buy Bitcoin at lower prices.

I personally recommend pairing your rig with cold wallets for security, because in the volatile crypto world, protecting your mined assets is as crucial as the investment itself.

You may not expect the community perks, but 2025 Southeast Asia mining farm hosting discounts include networking events.

Navigating Dogecoin mining investments in Kenya involves some hurdles like power outages, but the overall profitability and excitement make it worthwhile for enthusiasts.

This Bitcoin reading exercise boosted my confidence; after working through it, I felt ready to discuss crypto basics without feeling lost.

For me, selling Bitcoin directly to friends or family has been a reliable way to cash out without exchange fees; just be clear on the price.

Their eco-friendly approach to mining farm hosting ensures long-term viability and profitability.

This software’s integration with popular wallets makes transferring Bitcoin effortless, which is a huge plus when you’re dealing with micro-earnings.

I use my Mac to keep an eye on Bitcoin prices daily—Apple’s notifications combined with native widgets make it real easy to stay informed on the market moves.